Best Practices in Yoga

Yoga is one of the most famous way of life from ancient period. Yoga is not new. It has been practiced in many parts of the world for decades. Yoga is essentially a spiritual discipline based on an extremely subtle science, which focuses on bringing harmony between mind and body. It is an art and science of healthy living. The word 'Yoga' is derived from the Sanskrit root 'Yuj', meaning 'to join' or 'to unite. As per Yogic scriptures the practice of Yoga leads to the union of individual consciousness with that of the Universal Consciousness, indicating a perfect harmony between the mind and body, Man & Nature. According to modern scientists, everything in the universe is just a manifestation of the same quantum firmament. One who experiences this oneness of existence is said to be in yoga, and is termed as a yogi, having attained to a state of freedom referred to as mukti, nirvana or moksha. Thus the aim of Yoga is Self-realization, to overcome all kinds of sufferings leading to 'the state of liberation' (Moksha) or ‘freedom’ (Kaivalya). Living with freedom in all walks of life, health and harmony shall be the main objectives of Yoga practice." Yoga” also refers to an inner science comprising of a variety of methods through which human beings can realize this union and achieve mastery over their destiny. Yoga, being widely considered as an ‘immortal cultural outcome’ of Indus Saraswati Valley civilization – dating back to 2700 B.C., has proved itself catering to both material and spiritual upliftment of humanity. Basic humane values are the very identity of Yoga Sadhana. Yoga works on the level of one’s body, mind, emotion and energy. This has given rise to four broad classifications of Yoga: karma yoga, where we utilize the body; bhakti yoga, where we utilize the emotions; gyana yoga, where we utilize the mind and intellect; and kriya yoga, where we utilize the energy.

Importance of Yoga: Before we get into the benefits of Yoga, it is essential to understand what exactly Yoga really is. Yoga is not a religion, it’s a way of living that aims towards a healthy mind in a healthy body. Man is a physical, mental and spiritual being; Yoga helps in developing the balance between all the three as stated in Ayurveda in India. Other forms of exercise, like aerobics, only assure physical wellbeing. These exercises have very little to do with the improvement of spiritual or astral body.

Yoga is not just about bending or twisting the body and holding the breath. It is a technique to bring you into a state where you see and experience reality simply the way it is. If you enable your energies to become exuberant and ecstatic, your sensory body expands. This enables you to experience the whole universe as a part of yourself, making everything one, this is the union that yoga creates.

The founder of Yoga, Patanjali stated, "Sthiram sukham asanam." It implies that a posture that appears to be firm and agreeable is your asana. You may be astounded to know that an asana is just a preliminary step into the act of yoga. It is a way that encourages you to achieve the greater good. Yoga focusses on idealizing concordance between your mind, body, and soul. When you adjust yourself so everything functions brilliantly within you, you will draw out the best of your capabilities.

- Enhanced Circulation:

Yoga improves your blood circulation. This means better transportation of oxygen and nutrients throughout the body. Improved blood flow also indicates healthier organs and glowing skin. - Improves Posture:

Yoga teaches how to control and how to balance. With regular practice, your body will automatically assume the right stance. You will look both confident and healthy. - Uplifts your mood:

Practicing yoga on regular basis uplifts your mood instantly as it leaves your body with refreshing energy. - Lowered Blood Pressure:

Practicing yoga on daily basis enhances the blood circulation in the body. This enables oxygenation in the body due to which there is a significant reduction in the blood pressure as the body calms down. - Keeps Premature Aging at Bay:

Why not age gracefully and not before time? Yes, yoga helps you detox and eliminate toxins and free radicals. This, apart from other benefits, helps delay aging too. Yoga also relives stress which is yet another factor that beats aging. - Reduces Stress:

When you are on your yoga mat, you focus on the practice. This means that all your focus is concentrated on the matter at hand, and your mind slowly drains out the stress and troubles that are plaguing it. - A Drop in The Pulse Rate:

Yoga eases the body by reducing the strain. When the body relaxes, the pulse rate decreases. A low pulse rate indicates that your heart is strong enough to pump more blood in a span of fewer beats. - Increases Strength:

You use the weight of your own body to increase your strength. This is a very bewildering method of strength training. - Anxiety Management:

A little twisting, bending and controlled breathing helps you overcome anxiety. - Better Cardiovascular Endurance:

Yoga improves oxygenation in the body and also lowers the heart rate. This results in higher cardiovascular endurance. - Lowered Respiratory Rate:

Yoga involves a whole lot of controlled breathing. It entails filling your lungs to their full capacity, thus allowing them to work more efficiently. - Fights Depression:

When you practice yoga, repressed feelings surface. While you may feel sad, the negative energy is released. This helps to combat depression. - Teaches Balance:

Yoga also focusses at improving balance and also allows you to gain control over your body. Regular practice of yoga will enhance your ability to balance the poses in the class and focus well outside the class. - Stimulation of Organs:

The internal organs are massaged when you practice yoga, thereby increasing your resistance to diseases. Also, once you are attuned to your body, after years of practice, you will be able to tell instantly if your body doesn’t function properly. - Increased Immunity:

Yoga and Immunity go hand in hand. As yoga works towards healing and enhancing every cell in the body, your body automatically becomes more immune. Thereby, increasing your immunity. - Instills Full Body Awareness:

Practicing yoga on regular basis will help you become aware of your own body. You will begin to make subtle movements in order to enhance your alignment. With time, yoga helps you to become comfortable in your own skin. - Improvement in Gastrointestinal Health:

Practicing yoga regularly activates the digestive system and the other stomach related diseases like indigestion and gas are eliminated. Therefore, gastrointestinal functions improve in both men and women. - Increasing Core Strength:

It is essential to understand when your core is strong, your body is strong. Your core holds the weight of your body. It helps in increasing your resistance to injuries and also help you heal better. Yoga works on the core and makes it healthy, flexible and strong. - Higher Levels of pain Tolerance:

Yoga increases the level of pain tolerance and also works towards reducing chronic pain. - Increased Metabolism:

Yoga keeps the metabolism in check since a balanced metabolism is essential to achieve ideal weight. - Improved Sexuality:

Yoga increases your self-confidence and offers complete relaxation and more control. This gives your sexuality a much-needed boost. - Renewed Energy:

Yoga has the ability to make your mind and body feel rejuvenated. People who perform yoga on daily basis feel energized after a session of yoga. - Improves sleep:

Yoga helps you relax your mind completely. It helps you work on unnecessary tensions, thus facilitating better sleep. - Integrated Function of the Body:

Yoga means unison. When you practice yoga on regular basis, your mind starts to work in union with your body. This enhances movement and grace. - Allows- Self Acceptance:

Yoga enables self-awareness and betterment of health. Your self-esteem improves, and you become more confident. - Builds Self – Control:

The controlled movements of yoga teach you how to render that self-control to all the aspects of your life. - Brings about a Positive Outlook to Life:

Many hormones in the nervous system are stabilized when yoga is practiced on the regular basis. This helps you becomes more positive and you tend to look at life with refreshed and positive perspective. - Reducing Hostility:

When yoga is performed on the regular basis, the anger is greatly controlled. The breathing and meditation calm the nervous system, thereby decreasing anger and hostility. Reduction in hostility means reduction in blood pressure. This automatically enables a stress free and healthier approach towards life. - Better Concentration:

Performing yoga every day will eventually result in better concentration and in less than eight weeks of yoga practice, you will find yourself more motivated. - Tranquility and Calmness:

The breathing and meditation enables you disengage from your thoughts. This helps you calm down. With everyday yoga practice, you will notice how the calmness is no longer just a part of your practice – it becomes a way of life!

Yoga transforms your life and broadens your horizons in ways you can never imagine. It is absolutely worth trying!

Issues and Challenges in Implementation of Yoga: Patanjali lists nine obstacles that arise from the distractions of the mind. These can prevent us from practicing yoga or from a liberated life in general. These are the nine obstacles, according to Patanjali,

- Vyadhi – Disease:

- Styana – Mental lethargy, exhaustion:

- Samsaya – Doubt:

- Pramada – Carelessness:

- Alasya – Indolence, laziness

- Avirati – Attachment to worldly things

- Bhrantidarshana – Delusion:

- Alabdabhumikatva – The inability to gain solid ground under one’s feet:

9. Anavasthitatvani – Impermanence, Losing concentration leads to instability.

Other than these challenges there are so many issues like, religious orthodox thinking, misconnect of yoga knowledge, improper living standard, lack of interest, social restriction etc.

Issues and Challenges in Implementation of Yoga: Patanjali lists nine obstacles that arise from the distractions of the mind. These can prevent us from practicing yoga or from a liberated life in general. These are the nine obstacles, according to Patanjali,

- Vyadhi – Disease:

- Styana – Mental lethargy, exhaustion:

- Samsaya – Doubt:

- Pramada – Carelessness:

- Alasya – Indolence, laziness

- Avirati – Attachment to worldly things

- Bhrantidarshana – Delusion:

- Alabdabhumikatva – The inability to gain solid ground under one’s feet:

In NEP-2020 syllabus (Co-curricular) Physical Education and Yoga paper is compulsory for all students. In our college, we conduct regular Yoga practice inside college campus and nearby place in Bhartendu Udyan. Students and Teachers as well as college staff regular attend yoga practice. On the occasion of International Yoga Day 21st June we celebrate yoga practice at huge level where maximum students, teachers and staff and other person participate in this program.

Best Practices on Income Tax and GST

Objectives of the Practice:

- To provide clear and accessible information about tax laws, regulations, and

- To disseminate information to all personnel, students, and nearby businesses with the goal of facilitating the submission of returns for both Income Tax Returns (ITR) and Goods and Services Tax Returns (GSTR).

- To implement training programs to improve accuracy in

- To regularly review and update tax planning

- To promote awareness of the importance of tax

In accordance with Article 265 of the Constitution of India, no tax shall be imposed or gathered unless authorized by law. The Constitution grants the authority to impose and collect taxes, whether direct or indirect, to both the Central and State Governments. This authority stems from Article 246, which empowers the Parliament and State Legislatures to enact laws pertaining to the subjects listed in the Seventh Schedule of the Constitution. The Seventh Schedule comprises three lists that specify the subjects under which the Parliament and State Legislatures are authorized to legislate for the imposition of taxes.

Income tax, as stipulated by the Constitution of India, is a central-level direct tax. This taxation mechanism plays a pivotal role in generating significant revenue for the government, which is crucial for maintaining law and order, ensuring national security against external threats, and promoting the overall welfare of the populace. The government, in fulfilling its primary duty, implements welfare and development programs aimed at reducing socio-economic disparities. To fund such initiatives, the mobilization of funds from diverse sources, whether direct or indirect, becomes imperative. Income tax emerges as a key instrument in achieving a well-rounded socio- economic growth strategy.

The Goods and Services Tax (GST) is a consumption tax imposed on the value added at each stage of the supply chain for goods and services within a country. It is designed to be a comprehensive, indirect tax that replaces multiple cascading taxes previously applied to goods and services. In technical terms, GST operates on a destination principle, meaning that it is levied on the final consumption of goods and services rather than at each stage of production. The tax is applied to the value addition that occurs at each step in the supply chain, and businesses are responsible for collecting and remitting the tax to the government. At its core, GST is a multi-stage and destination-based tax system. Businesses that are part of the supply chain, from raw material extraction to the final sale of the product or service, are required to charge GST on the value they add to the product or service. The tax is then passed on to the end consumer, who ultimately bears the economic burden of the tax. The implementation of GST involves meticulous tracking of transactions, and businesses are required to maintain detailed records of their sales and purchases.

This allows for the calculation of the GST liability at each stage and ensures that the tax is appropriately collected and remitted. The tax is typically administered through a structured framework, with provisions for input tax credits, allowing businesses to offset the GST they paid on inputs against the GST they collect on outputs.

The Context of the Practice:

In the contemporary landscape, the processes associated with Income Tax Return (ITR) and Goods and Services Tax Return (GSTR) filings have evolved into intricate procedures, often posing challenges for individuals and businesses. The demand for consultancy services to navigate these complexities has surged, accompanied by a parallel increase in associated costs.

Amidst this scenario, our college has positioned itself as a valuable and efficient platform to address these challenges. By offering a comprehensive solution, our institution aims to streamline and simplify the ITR and GSTR filing processes. This initiative is particularly advantageous for individuals and businesses seeking a cost-effective alternative to engaging consultancy services.

The platform provided by our college is designed to furnish users with the necessary tools, resources, and guidance to facilitate a smoother ITR and GSTR filing experience. This approach not only mitigates the complexities associated with compliance but also presents a more economical option compared to the high costs associated with hiring external consultancy services in the current market.

The Practice:

The college provides professional advisory services in the areas of income tax and Goods and Services Tax (GST) to local clientele, including students, employees, and business professionals. These consultancy services encompass comprehensive assistance in navigating the intricacies of income tax regulations and GST compliance. The college's offerings may include tax planning, preparation and filing of income tax returns, GST registration and return filing, as well as expert guidance on tax-efficient financial strategies. The aim is to furnish clients with accurate, up-to- date information, ensuring adherence to relevant tax laws and optimizing financial outcomes for individuals and businesses within the local jurisdiction. The following practice are as:

- Submit all GST returns accurately and within stipulated

- Submit all income tax returns accurately and on time.

- Implement technology solutions to streamline GST filing

- Stay updated on changes in GST laws and

- Conduct regular training sessions for employees involved in GST

- Maintain thorough documentation supporting GST

Procedure for filing Income Tax Return:

Filing Income Tax Returns (ITR) in India involves several steps. Here's a general overview of the procedure:

1. Determine Your Income Source:

- Identify all sources of income, including salary, business income, rental income, capital gains, and any other applicable

2. Gather Necessary Documents:

- Collect supporting documents such as Form 16 (for salaried individuals), bank statements, investment proofs, and other relevant financial documents.

3. Choose the Right ITR Form:

- Select the appropriate Income Tax Return (ITR) form based on your income There are different forms for different types of income and taxpayers.

4. Download the ITR Form:

- Download the selected ITR form from the official Income Tax Department website (https://www.incometaxindiaefiling.gov.in/).

5. Fill in the ITR Form:

- Fill in the form with accurate details such as personal information, income details, deductions, and tax

6. Compute Tax Liability:

- Calculate your total income, deductions, and tax Ensure that you are eligible for any deductions or exemptions you claim.

7. Validate the ITR Form:

- Validate the filled-in ITR form to check for errors and ensure that all mandatory fields are

8. Generate XML File:

- After validation, generate the XML file of the completed ITR form using the utility provided on the income tax e-filing

9. Register on the e-Filing Website:

- If you haven't already, register on the official Income Tax e-filing website (https://www.incometaxindiaefiling.gov.in/).

10. Login and Upload XML File:

- Log in to your account on the e-filing portal and navigate to the "Upload Return" Upload the XML file generated from the ITR form.

11. Verify ITR:

- After uploading the XML file, you will need to verify your ITR. This can be done electronically through methods such as Aadhaar OTP, EVC (Electronic Verification Code), or by sending a signed physical copy of the ITR-V to the Centralized Processing Centre (CPC) in Bangalore within 120 days of e-filing.

12. Check ITR Status:

- Keep track of your ITR status on the e-filing portal. Once processed, the status will be

13. Receive Acknowledgment:

- Upon successful e-verification or submission of the signed ITR-V, you will receive an This is proof that your ITR has been filed.

Procedure for filing GSTR:

Goods and Services Tax Return (GSTR) filing in India involves a series of steps. The process can vary based on the type of taxpayer and the nature of transactions. Here's a general overview of the procedure:

1. Registration:

- Ensure that you are registered under the Goods and Services Tax (GST) If not, complete the GST registration process through the GST Common Portal.

2. Login to GST Portal:

- Visit the official GST portal (https://www.gst.gov.in/) and log in using your

3. Select the Relevant GSTR Form:

- Choose the appropriate GSTR form based on your business type and Different GSTR forms are prescribed for different types of transactions and taxpayers.

4. Fill in the GSTR Form:

- Fill in the details in the selected GSTR form. This includes information about outward supplies (sales), inward supplies (purchases), input tax credit (ITC), and other relevant details.

5. Verify Details:

- Verify the details entered in the GSTR form to ensure accuracy. Cross-check with supporting documents such as invoices, receipts, and other financial

6. Save and Preview:

- Save the entered data and preview the GSTR form to check for any errors or missing

7. Compute Tax Liability:

- The GSTR form will automatically compute your tax liability based on the information Ensure that the tax calculations are accurate.

8. Submit GSTR Form:

- After verifying and ensuring accuracy, submit the GSTR form on the GST Once submitted, the form cannot be modified.

9. Payment of Tax:

- If there is any tax liability after submitting the GSTR form, make the payment through the available modes such as online banking, credit/debit cards, or other prescribed

10. Generate Challan:

- In case of a tax payment, generate the GST Challan for the amount payable. Use the generated challan to make the payment through the designated

11. Filing of GSTR:

- After the payment is made, the GSTR form is ready for File the GSTR form using the 'File Return' option on the GST portal.

12. Acknowledgment:

- Once the GSTR is successfully filed, you will receive an acknowledgment in the form of an acknowledgment number. This confirms the submission of your

13. Reconciliation and Rectification (if needed):

- Regularly reconcile your GSTR data with your books of accounts and rectify any Amendments or rectifications can be made in subsequent returns.

Water Conservation in HCPG College

Our Mother Earth nurtures and nourishes us in our daily life, hence it is our responsibility to preserve and conserve the same. Water scarcity is a growing concern, especially in places like Varanasi, where the groundwater levels have alarmingly decreased in recent years. In such a scenario, the College is committed to the objective of water conservation. The college promotes water conservation by rainwater harvesting, usage of renewable sources of energy like solar energy and reduced wastage of potable water.

1. Rainwater Harvesting- Conserve water for the future

Water scarcity is one of the growing concerns of the present times, the only solution for which is water conservation. It is taken care of at different levels in the College, from rainwater harvesting to tree plantation to use waste water and reduced wastage of water. Realizing that rainwater harvesting is imperative for the future water needs of the campus, Harish Chandra P.G. College has set up rainwater harvesting system using abandoned bore-well. Rain water collected from roofs of the buildings is drained through pipes into the bore-well. This water reaches down and enriches groundwater table.

2. Water Boring

The institution has decided to drill for boring pumps only when acutely needed. Regular maintenance and upkeep of the boring pumps & pipes is carried out by the institution.

3. Reduced Water wastage from overhead tanks:

The college has four overhead tanks one each at the top of the roof of A, B and C-Blocks and one above new building. Water is uplifted to these storage tanks with the help of two submersible pumps installed in the college campus. In order to stop wastage of water from overflowing storage tanks, water level alarm indicators have been installed in all the four tanks.

4. Steps Towards Water conservation

Left over water from different staff rooms and laboratories are used for watering plants growing in the campus.5. Maintenance of Water Distribution System

The institution has a well established procedure for the maintenance and repairing of water supply system in the college. Services of plumbers are hired in order to do this task on regular basis.

6. Awareness of water conservation

The college ensures that the awareness of water conservation reaches the public by organising regular programmes. Guest lectures series by environmentalists, and competitions on the theme of environmental issues are also organised.

7. Awareness Activities to install Water Conservation among Young Minds

Water conservation rallies and awareness programmes are organised during NSS and NCC camps. Faculty members of the college particularly of Life Science and Chemistry department have served as resource person in different institutions of Varanasi district to bring awareness about water conservation.

8. National Level Online Webinar on Water Conservation-

Several National level online Webinars on Water Conservation are organised by different departments of the institution on regular basis.

Best Practices

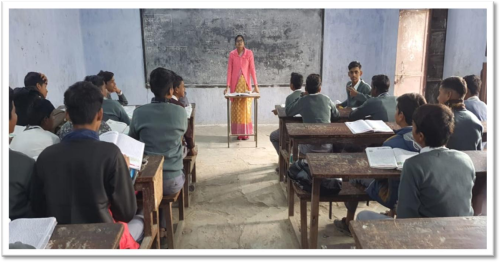

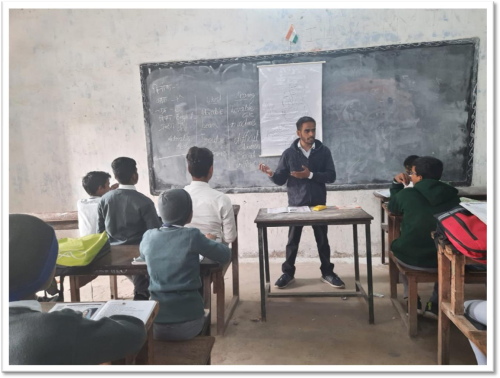

1. Best Practice: Practice Teaching

Practice teaching performed by the students of B.Ed. Programme of Harish Chandra Post Graduate College at nearly located Inter colleges.

2. Objectives of the Practice Teaching

- To prepare future teachers.

- To develop personality of the trainee teachers.

- To develop communication skill.

- To develop the tolerance ability.

The trainee teachers get familiar with the actual school Environment and observe the administrative as well as managerial activities of the institution. They feel the actual responsibilities of the teachers which helps them in future. The students will be able to learn connection between teaching and learning and also the taxonomy of teaching and learning.

Principles of Practice teaching

- To introduce the topics in an effective as well as appropriate manner.

- To learn effective manners and methods of teaching different subjects for different stages.

- Use of TLM to make the teaching effective.

The Practice teaching articulates how teachers can deliver the syllabus and engage students.

This practice is directly related to topics to be taught and regular assessment. It helps to determine the students’ need and understanding.

Each principle is supported by the theory of action that describes how the work of teachers can improve student learning time. Major principles of practice teaching are:

- Promote intellectual engagement and self awareness of students.

- Promote inclusion and collaboration among students.

- Improve students’ voice and body language.

- Develop curriculum planning and implementation mechanism.

- Develop professional values and ethics among students.

3. The Context

- Lack of understanding of Learning approach for different subjects.

- Lack of laboratory schools according to learning medium of students.

- Time pressure from the Laboratory schools.

- Rigidity of curriculum.

- Lack of resources.

4. The Practice

This practice prepares the prospective teachers. This program is designed according to the needs of the education system of our country and provisions of POP (Professor of Practice) for different programmes.

It helps to develop the professional skills among students. It works for both pre- service as well as in-service teachers. It updates the teacher’s professional skills through Orientation Programmes, Refresher courses and Seminars workshops etc.*

5. Evidence of success

- Placement of huge number of students in teaching profession.

- Most of students have qualified National and State level Teaching Eligibility test.

- Good learning outcomes of laboratory school students.

- Positive behavioural changes among personality of prospective teachers.

6. Problems Encountered and Resources required

- Lack of funds.

- Lack of teaching supervisors (Human resources).

- Non-availability of Laboratory Schools

- Lack of ICT equipments.

- Negative attitude about teaching profession among trainee students.

- Problems faced during practice teaching.

7. Notes

- Student : Teacher ratio must be maintained.

- Laboratory schools should be attached with the practicing institutions.

- Flexibility according to the local need of students should be provided.